|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

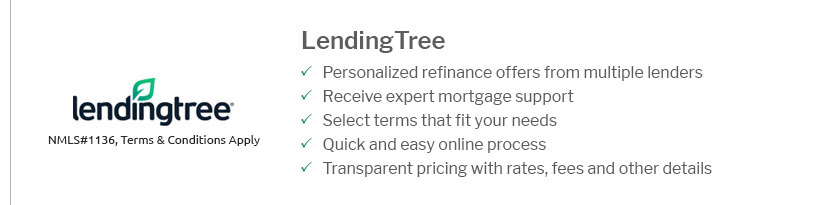

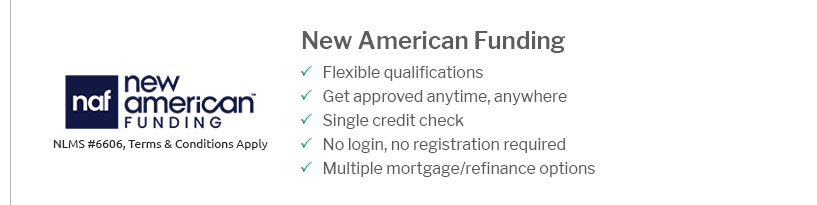

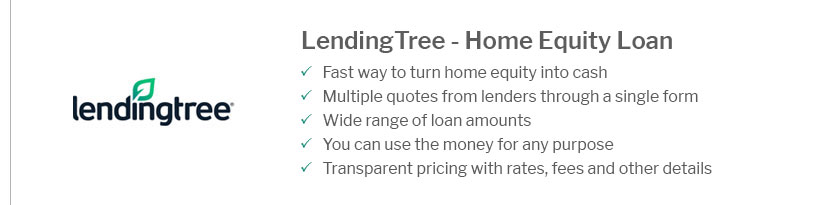

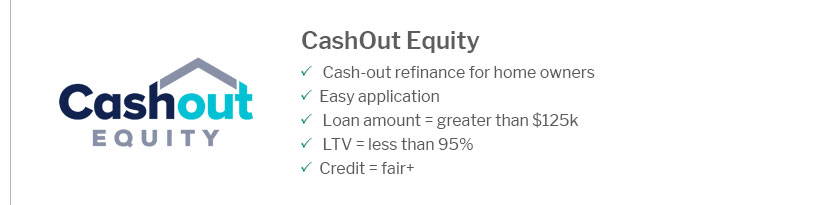

Top Rated Refinance Mortgage Lenders: A Comprehensive OverviewRefinancing your mortgage can be a strategic financial move, especially when working with top-rated lenders. This article will explore some of the best lenders in the industry, providing insights into their offerings and how to choose the right one for your needs. Why Refinance Your Mortgage?Refinancing can help you secure a lower interest rate, reduce monthly payments, or access cash for other needs. It’s essential to understand the benefits and potential drawbacks before making a decision. Lower Interest RatesOne of the primary reasons homeowners refinance is to take advantage of lower interest rates. This can significantly reduce your overall payment amount over the life of the loan. Accessing Home EquityRefinancing allows you to tap into your home’s equity for various purposes. For example, some homeowners use a cash out refinance for home improvements, investing in upgrades that can increase their home's value. Top Rated Refinance Mortgage LendersChoosing the right lender is crucial. Here’s a look at some top-rated options:

Factors to ConsiderWhen selecting a lender, consider the following factors:

How to Apply for a RefinanceThe application process for refinancing is similar to applying for your original mortgage. You’ll need to gather financial documents, fill out an application, and await approval. Documentation RequiredBe prepared to provide income statements, tax returns, and details about your current mortgage. Understanding what’s needed can expedite the process. For those considering unique properties, it's also possible to can you refinance a mobile home under certain conditions, which is worth exploring. Frequently Asked Questions

https://www.consumeraffairs.com/finance/finance__companies.htm

Looking for the best mortgage lender? Our top picks include New American Funding, Cardinal Financial, AmeriSave and Rocket. https://www.reddit.com/r/Mortgages/comments/1fyzjit/current_options_for_refinance_rocket_loan_depot/

NEXA, C2, Loan Factory, Future Financial are some of the largest mortgage brokers who get the most competitive rate sheets. They also have a lot of coverage ... https://finance.yahoo.com/personal-finance/mortgages/article/best-mortgage-refinance-lenders-161445533.html

The best mortgage refinance companies of January 2025 offer a combination of low fees and competitive interest rates.

|

|---|